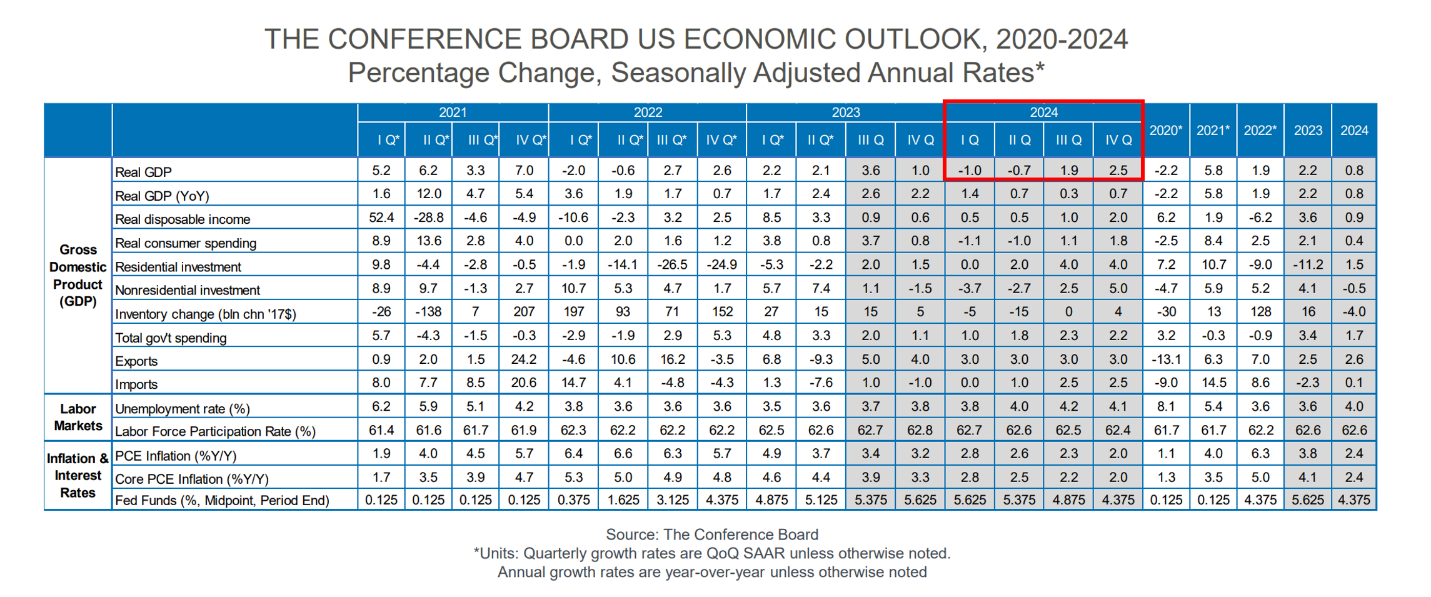

A mild recession will begin in the first quarter of 2024 and end in the second quarter, economists at The Conference Board (TCB), a think-tank for the world’s largest companies predicted Wednesday.

The big business group’s economics team expects an interest rate hike before the end of 2023, followed by two negative quarters of -1% and -0.7% before the Federal Reserve loosens credit and lowers the cost of borrowing.

“We see a lot of headwinds on the horizon,” Erik Lundh, principal economist at TCB said. “Spending activity towards the end of 2023 and into early 2024 is going to be pulled back. On an inflation-adjusted basis spending is not being underpinned by personal income growth and real personal income growth.”

The massive savings built during the pandemic is nearly depleted, Mr. Lundh said. Interest rates on credit card debt and car loans are higher than in years, he added, and mandatory payments on student loans are about to begin again. As a result, consumer spending will soften, causing a recession to begin early in 2024.

TCB’s outlook is gloomy, but it is predicting a strong comeback in the second half of 2024, with +1.9% growth in the third quarter and +2.5% growth in the final quarter of 2024.

The economy outperformed TCB’s expectations for the last two quarters. Economist Fritz Meyer, who we regularly quote in this space, says the recent strength of new-job creation data released last week makes a recession in the first quarter of 2024 unlikely.

With a Mideast war, oil prices and higher inflation add a new risk to the outlook. However, trying to time the stock market based on the economic outlook is unwise.

Rather, investors should consider a recession early next year as one scenario to be prepared for but remain focused on the longer-term outlook. Even if TCB’s economists are right, a recession is expected to be short-lived and mild. Moreover, the stock market often discounts the outlook over the next several months and may already reflect a mild recession to come.