The Standard & Poor’s 500 surged 1.9% Friday, as super-capitalized tech giants Alphabet and Netflix surged. Tech’s sharp one-day advance is making headlines now but investing in a portfolio for retirement income or for the benefit of the next generation is not about a single day’s return.

In an environment in which the media constantly headlines single-day returns, we’re here to help you stay focused on what’s more important: longer term returns.

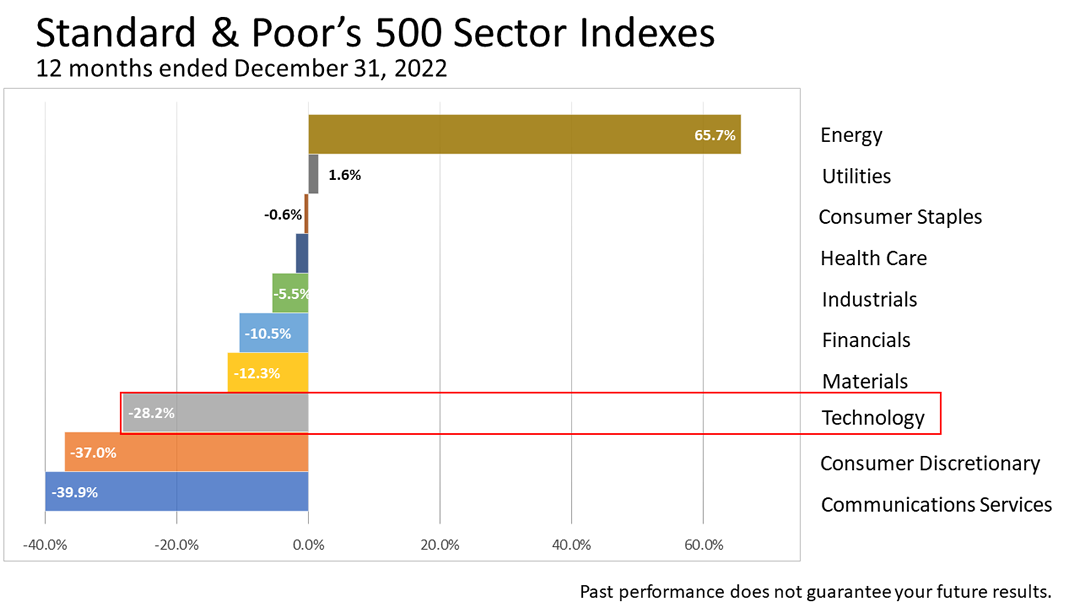

Here are 12-month industry sector returns for 2022, as defined by Standard & Poor’s. Tech sector stocks lost a whopping 28.2% of their value in 2022. The stinging loss in the year ended December 31, 2022 is a fact commonly omitted in Friday’s coverage of the stock market by major financial media.

Daily headlines rarely mention longer-term performance or how a one-day surge fits in with a portfolio managed for a prudent investor over the long run.

We’re here to remind you that financial news is often irrelevant to permanent investors, whose goals are building a portfolio to generate income in retirement or to benefit the next generation. The financial media’s main focus is on trading by Wall Street professionals, which is not the focus of an investor building a portfolio that is invested for a lifetime.

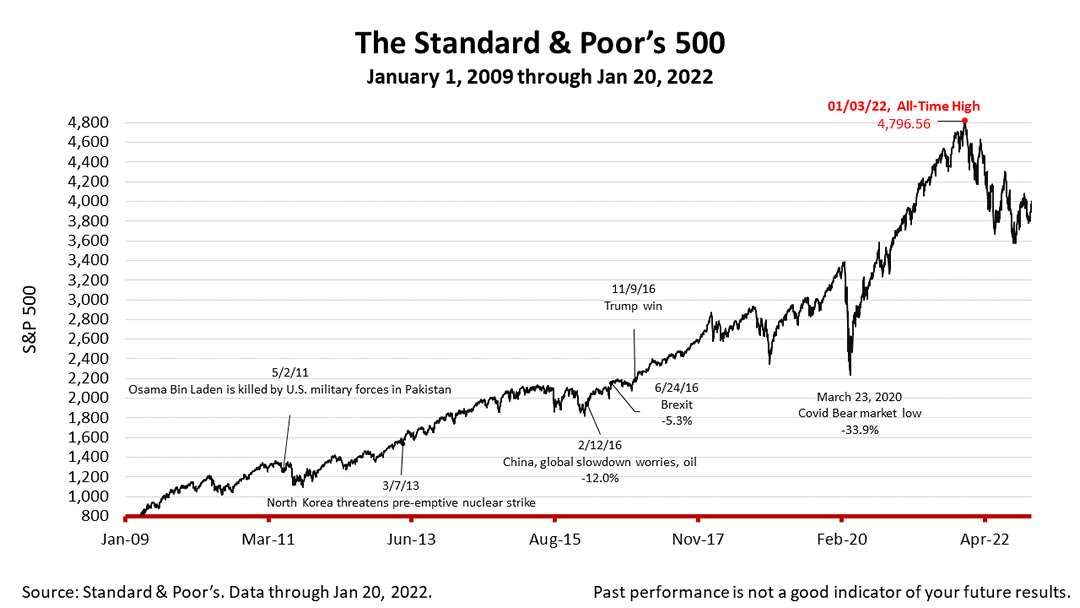

The S&P 500 stock index closed Friday at 3,972.61 gaining 1.89% from Thursday, and down -0.66% from a week ago. The index is up 77.55% from the pandemic bear market low on March 23, 2020, and -17.17% lower than its January 3, 2022, all-time high.

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is a market-value weighted index with each stock's weight proportionate to its market value. Index returns do not include fees or expenses. Investing involves risk, including the loss of principal, and past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted.