The Federal Reserve raised the target range for its benchmark interest rate by 0.25% on Wednesday to a range of 4.75%-5%, the highest since October 2007.

The decision by the 12 central bankers on the Federal Open Market Committee (FOMC) had been highly anticipated since March 10, when a run by depositors at Silicon Valley Bank spread fears that a banking crisis could destabilize the U.S. economy.

The stock market reacted by falling sharply. Following the 2 p.m. EST release of a policy statement by the FOMC and the regularly scheduled 45-minute press conference after every meeting of Fed policymakers by Jerome Powell, chairman of the Fed’s Board of Governors, the Standard & Poor’s 500 stock index declined by -1.65%.

Important Backstory on What’s Happening Now

The Fed in 2021 incorrectly predicted inflation was “transitory.” Post-pandemic supply chain disruptions would subside, and inflation would revert closer to the 2% rate targeted by the FOMC. But post-pandemic supply chain problems took much longer to fix than expected by the central bank; then came Russia’s invasion of Ukraine in February 2022. Inflation was well on its way to a 40-year high by the time the Fed reacted and the FOMC has been playing catch-up for the past year. In one of the most aggressive monetary tightening campaigns since the enactment of the Federal Reserve Act of 1913, the Fed has hiked lending rates nine times since March 2022.

What’s It Mean to Strategic Financial Planning

Before the bank runs erupted on March 10, the FOMC had been expected to hike rates by a half-point. The Fed’s decision Wednesday to raise rates one quarter of 1% shows the FOMC thinks the destabilizing effects of the bank turmoil are not big enough to distract policymakers from the inflation problem.

The Fed’s action indicates problems faced by banks with a lot of depositor accounts exceeding the $250,000 maximum amount guaranteed by Federal Deposit Insurance Corporation (FDIC) can be stabilized. Some banks may fail, and stockholders and bond investors could see their investments wiped out. Bailing out mismanaged banks would be morally hazardous. It would incentivize investors to no longer worry about investing in stocks or bonds, which are risk assets. However, increasing FDIC insurance limits or adding Fed facilities to shore up banks is not a moral hazard. Fulfilling a promise to bank depositors that their cash is safe is sensible. Otherwise, bank depositors would need to research how their banks are investing their assets on a daily basis, which would add risk to bank accounts that deposit insurance has long been thought to have eliminated.

The FOMC’s decision to hike rates Wednesday acknowledges that recent bank runs added a new risk to the investment outlook, but the risk is not large enough to stop it from pursuing its main goal of lowering inflation.

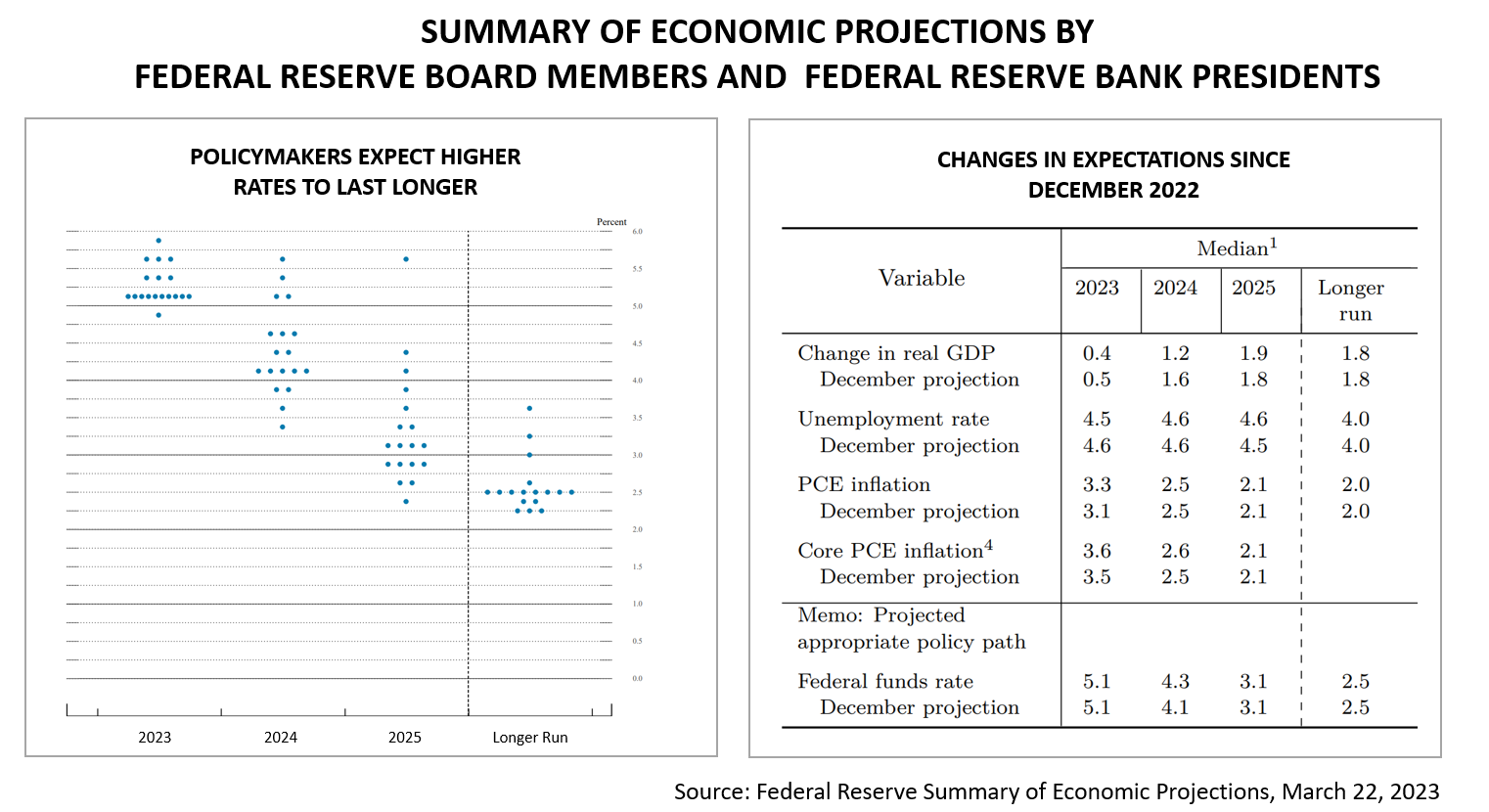

The summary of economic projections by the Federal Reserve Board members and seven additional Fed district branch presidents shows the central bankers expect to keep rates higher for longer than they did in December. They expect economic growth of 0.4% in 2023, down from their prediction of 0.5% in December, and their 2024 expectations for economic growth were trimmed from 1.6% to 1.2%.